special tax notice 401k rollover

Merrill Lynch has neither reviewed nor participated in the creation of the information contained herein. You are receiving this notice because all or a portion of a payment you are receiving from.

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

. If you do not roll over the entire amount of the payment the portion not rolled over will be taxed. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth. Special Tax Notice Regarding Retirement Plan Payments Your Rollover Options.

Office of Personnel Management Form Approved. This notice is intended to help you decide whether to do such a rollover. If you do not roll over the entire amount of the payment the portion not rolled.

Rollover the balance and will no longer be invested in the investment options available under the Plan. The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. Order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld.

If you do not roll over the entire amount of the payment the portion not rolled. Special Tax Notice Regarding Your Rollover Options. Rollover the Plan is required to withhold 20 of the payment for federal income taxes up to the amount of cash and prop-erty received other than employer stock.

SPECIAL TAX NOTICE REGARDING YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Retirement Systems of. Retirement Operations OMB No. The attached Special Tax Notice explains the federal income tax consequences of.

Order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld. GENERAL INFORMATION ABOUT ROLLOVERS Voya Retirement Insurance and Annuity Company VRIAC Voya Institutional Plan Services LLC VIPS Members of the Voya family of. SPECIAL TAX NOTICE This document is being provided by your employer.

This means that in order to. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS TAX INFORMATION RELATING TO LUMP-SUM DISTRIBUTIONS AND AMOUNTS ELIGIBLE FOR ROLLOVER This notice contains. Funds to make up for the 20 withheld.

You may roll over the payment to either an IRA an individual retirement account or individual retirement annuity or an employer plan a tax-qualified plan section 403b plan or. Order to roll over the entire payment in a 60day rollover you must use other - funds to make up for the 20 withheld. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

After-tax Contributions and Roth 401k plan deferrals1 After-taxrollover into an IRA. You may roll over your after-tax contributions to an IRA either directly or indirectly. Special tax notice required by the IRS that explains the tax treatment of your Plan payment that is not from a designated Roth account and describes the rollover options available to you.

A 60-day rollover to an employer plan of part of a payment that includes after-tax contributions but only up to the amount of the payment that would be taxable if not rolled over. If you do not roll over the entire amount of the payment the portion not rolled. Special Tax Notice Regarding Rollovers.

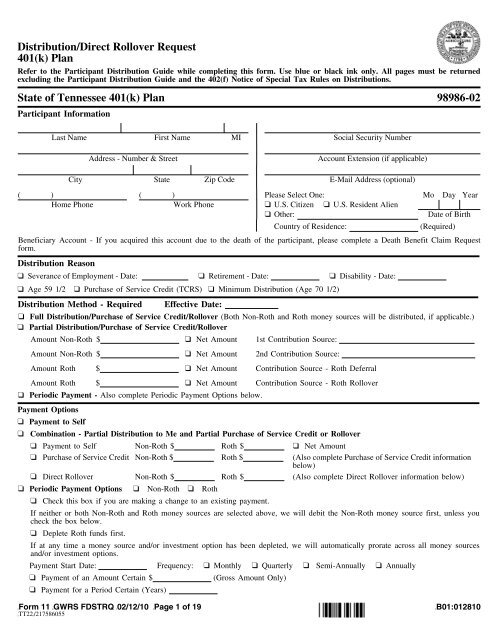

Distribution Direct Rollover Request 401 K Plan State Of Fascore

Your Rollover Options Tax Notice Visa

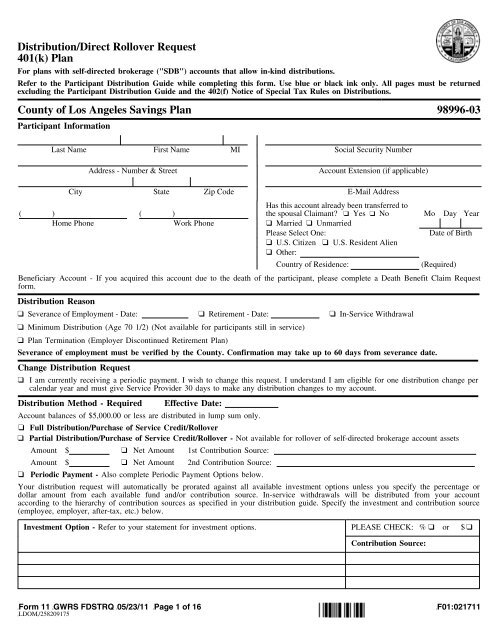

Distribution Direct Rollover Request 401 K Plan County Of Los